Thinking about refinancing your mortgage? The time to act may be now!

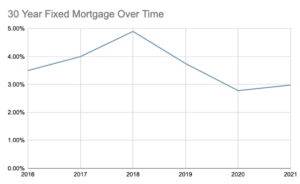

Chicagoans, if you are considering refinancing your current mortgage or taking out a new mortgage, you have most likely noticed that mortgage rates both in-state and nationwide are near all-time lows.

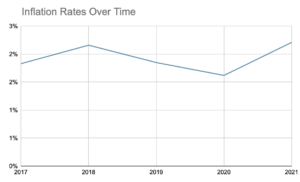

Don’t get too comfortable though! These attractive rates might not last for long. Mortgage rates are tied to the federal funds rate, which is the rate that the Federal Reserve sets for commercial banks to borrow and lend to each other overnight. Experts project the federal funds rate to rise soon to counter higher inflation, which would cause mortgage rates to rise subsequently.

The 30-year fixed mortgage rate is on the rise this week, reaching a three-month high and crossing the 3% hurdle after hovering below that mark for several weeks. Despite this recent increase, rates remain historically low – favorable circumstances for homeowners who are eligible to refinance their mortgages.

According to Fannie Mae, only a small fraction of homeowners refinanced montage over the past year. Those who did save around $300 monthly on average.

Sounds pretty good, right?

Yes, but make sure you consider the following before you refinance:

How long do you plan on living in your home?

- Refinancing comes with closing costs and fees.

- If you are moving soon, savings will be minimal.

What is your current mortgage standing?

The benefit you receive from refinancing depends on how much principal you have left to pay on your loan.

- If you have a high principal balance, refinancing is more favorable, most of your payment is going toward interest.

- If you have a low principal balance, refinancing won’t help as much, very little of your payment is going towards interest.

However, if your interest rate is high enough, you could still benefit from refinancing regardless of your principal balance.

Credit History

To get a favorable rate when you refinance, you need a good credit history. If your credit score is on the lower side, it may be wiser to work on rebuilding credit before looking to refinance.

More Info

Have questions about refinancing your mortgage? Movement Mortgage is a great place to start! One of the fastest growing lenders in the country, Movement Mortgage takes pride in providing fast, quality service. Over 75 percent of their loans are processed in just 7 business days.

For more information, head to www.movement.com or contact Chicago Loan Officer Ryan Cotter at (312) 607-1111

Leave a Reply

You must be logged in to post a comment.